The role of banks in shaping income inequality: A within-country study

Coccorese P., Dell’Anno R., 2023 – Review of Income and Wealth

While it is widely recognized that financial intermediation boosts economic growth, by both contributing to a more efficient capital allocation and relieving credit constraints, it is still an open question whether more developed banking and financial markets benefit all people rather than limited groups.

In a recent paper, “The role of banks in shaping income inequality: A within-country study”, published in the Review of Income and Wealth, Paolo Coccorese and Roberto Dell’Anno analyze the role of bank industry development in affecting income distribution within the Italian provinces over the years 2000-2018.

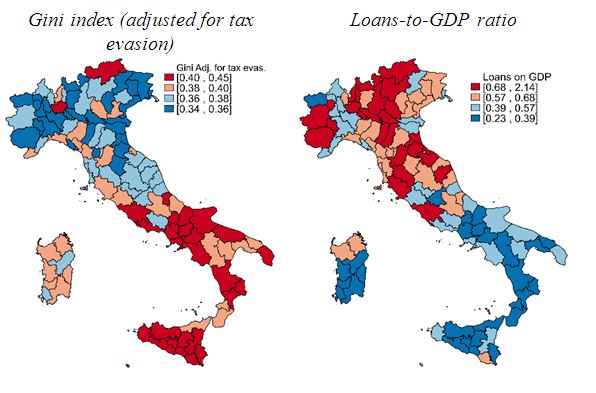

This article provides some interesting contributions to the related literature. First, from a methodological perspective, the authors control for measurement errors in the index of income inequality due to tax evasion. In particular, they calculate the Gini Index at the provincial level by adjusting administrative data collected from the Italian personal income tax returns (Dichiarazioni IRPEF) for underreporting. These adjustments suggest that the distribution of gross (reported) income is more unequal than the distribution of total (i.e., reported plus evaded) income. As for the measurement of the degree of access to bank credit, the authors use the ratio between loans and GDP at the provincial level.

Figure 1 shows the geographical distribution of the loans-to-GDP ratio and the Gini index adjusted for unreported income in 2018, highlighting an inverse correlation between the two variables, i.e. lower income inequality where lending is higher.

A further contribution of this study is to take into account also the role of banks’ market power in shaping income inequality.

From a theoretical perspective, in the literature there exist two main alternative hypotheses on the relationship between banking market power and income inequality. On the one hand, the traditional ‘market power hypothesis’ argues that increased banks’ market power would result in a lower supply of loans and higher lending rates, which is likely to tighten financing constraints and increase income disparities, while greater competition would ease the access to funding and thereby reduce income inequality. On the other hand, the ‘information hypothesis’ holds that higher market power would induce banks to invest in closer relationships with customers, hence diminishing information asymmetries and improving access to debt finance by opaque or risky borrowers, leading to less income inequality. To test which hypothesis dominates in the Italian context, the authors include two measures for assessing banking market power: the Lerner index (computed using two alternative methodologies) and the Herfindahl-Hirschman index of concentration.

The article provides two main conclusions. First, it offers robust evidence that a higher development of local banking markets leads to a more equal income distribution, supporting the inequality-narrowing hypothesis and suggesting that more loans from banks disproportionately help the poor, which is crucial for reducing income gaps. Second, this marginal effect increases in absolute value when the analysis considers the lagged values of the proxy of banking development, which upholds the hypothesis that loans require time to have effects on income distribution.

As for the role of market power in the banking industry in influencing inequality income, the empirical analysis only weakly supports the hypothesis that the degree of concentration of the banking sector at the provincial level affects the way banks select customers to which they lend. Consequently, there is no sound empirical evidence linking the competition of the local banking market with the Gini index.

From a normative perspective, these findings support the idea that more developed banking markets foster a more equal income distribution. As a policy implication, if governments are interested in reducing income disparities, they should pursue policies that promote a widespread presence of banks in the different geographical areas of the country and facilitate lending.

The analysis also provides some hints for further developments of this research topic. First, it might be interesting to assess the behavioral reasons behind these results. Specifically, from a theoretical viewpoint, the emerging economic rationale here is consistent with the conventional hypothesis that banking development increases individual income by reducing liquidity constraints, and that this effect is proportionally more relevant for the poor because they are more constrained than the middle and rich classes. Moreover, in a dynamic perspective, the population with the lowest incomes is likely to use loans to invest in human and/or physical capital more than richer people, in order to earn more in the future, thus allowing, through social mobility, also a reduction of intergenerational inequality.

However, the above interpretation should be considered only as speculative, because the present findings, as well as the existing empirical literature, can only partially disentangle the behavioral mechanism behind the reducing effect of banking development on income inequality. Indeed, this relationship depends on two interacting factors that are unobservable by using data on loan supply: (a) the income percentiles where the beneficiaries of bank loans are concentrated, and (b) how poor and rich borrowers use their loans, i.e. for buying consumption goods rather than for investing in human or physical capital. To investigate the behavioral reasons underlying the inverse relationship between banking development and income inequality, it is therefore desirable to integrate the research on the credit market supply side (as in our study) with a micro-econometric analysis on the demand side. That would allow one to test whether the evidence on the role of banks in shaping income inequality, as obtained by using aggregated data, is also validated by micro data.