Fiscal rules and the reliability of public investment plans: Evidence from local governments

Mancini A.L., Tommasino P., 2023 – European Journal of Political Economy

Reliable public investment plans are important both in terms of political accountability, as they help citizens to assess the choices and performances of incumbent politicians, and from an economic viewpoint, because they anchor firms’ expectations and reduce uncertainty. Not surprisingly, the IMF transparency code underlines that “Economic and fiscal forecasts and budgets should be credible”.

Unfortunately, politicians do not always have strong incentives to adopt the most transparent accounting practices. First, voters tend to overestimate the effects of public spending and underestimate the cost of financing it; second, they pay a lot of attention to public investment plans, but much less attention to their implementation. As a consequence, policy-makers have an incentive to “plan to cheat”. That is, they promise more expenditures than what they will actually deliver, because this allows them to improve their reputation.

Rules that constrain realized expenditures could contribute to more realistic spending plans, because they make the opportunity cost of spending more salient for voters, thus reducing the political pay-off of over-optimistic projects.

In the article “Fiscal rules and the reliability of public investment plans: evidence from local governments”, recently published in the European Journal of Political Economy, Anna Laura Mancini and Pietro Tommasino provide evidence in support of this theoretical intuition.

They build a dataset including the ex‑ante budget plans and the ex-post budget outcomes of all the about 8,000 Italian municipalities, which account for almost 57% of overall public administration investments.

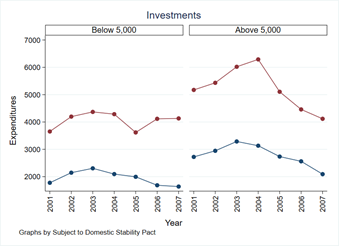

Municipal fiscal policy in Italy is subject to a set of rules (the so-called Domestic and Stability Pact, DSP), which has changed over time. Whereas before 2005 capital expenditures were excluded from the DSP, starting from that year they were subject to several constraints. The authors explore how this rule-change affected the planning accuracy of local governments, exploiting the circumstance that the DSP only applies to municipalities above 5,000 inhabitants, so that smaller municipalities provide a benchmark to assess the impact of the reform.

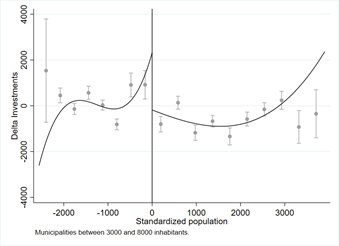

Two different micro-econometric techniques are used. First, a standard diff-in-diff framework, which identifies the causal effect under the assumption that – absent the policy intervention – the dependent variable would have followed parallel trends in the two groups (larger and smaller cities). Second, a difference-in-discontinuity (diff-in-disc) framework, which basically combines the diff-in-diff and the Regression Discontinuity Design (RDD) approaches. Indeed, a plain-vanilla static RDD would have not been able to isolate the effect of the DSP change, because at the 5,000 inhabitants’ threshold other differences in the rules appear (among which a jump in the wage of the mayor and of the members of the executive committee). Under the assumptions that: (i) without the DSP change, the effect of the confounding policies is constant over time in a neighborhood of the threshold (basically a local version of the “parallel trends assumption”) and (ii) potential outcomes are a continuous function of population at the threshold (which is the standard RDD requirement), the diff-in-disc can instead identify the effect of the only policy that changes both around the population threshold and over time, namely, the DSP pact. The analysis documents that Italian public administrations systematically overestimate capital expenditures (see Figures 1 and 2): almost half of planned expenditures are not realized ex post. Furthermore, the introduction, since 2005, of constraints on capital expenditures in larger municipalities reduced over-optimism in expenditure projections by about one third, largely due to a decrease in planned capital expenditures (realized capital expenditures were almost unaffected).

These results – which are robust to the use of different econometric techniques and to several statistical checks – are quantitatively relevant. Indeed, projecting the estimates on the universe of the 6,600 Italian municipalities in ordinary regions, one finds that the aggregate planning error amounts to around 25 billion euros (almost 60 per cent of the total public investment expenditure or, equivalently, about 1.6% of GDP).

The results have also relevant policy implications. For example, they suggest that relying on so-called “golden rules” might not be the best way to promote public investments, contrary to what it is often argued in the debate about the reform of the European fiscal framework. Indeed, before the introduction of the reform analysed in this study, Italian municipalities were subject to a “golden rule” (capital expenditures were not constrained by the DSP). However, the authors show that this lack of formal constraints only produced inflated capital budgets, with no tangible benefits in terms of actual investments.

As recently confirmed by IMF and OECD, policy emphasis should therefore shift from numerical to procedural rules. For example, the possibility of shifting funds between current and capital spending projects should be limited; priority in financing should be granted to the completion of already approved plans before launching new projects; projects should also be accompanied by realistic cost estimates. Last but not least, the assignment of funds from higher government levels (Regions and the Central Government) should also be conditioned on the actual advancement of investment projects (a similar provision is attached to the Next-Generation EU program).