Fiscal devaluation and relative prices: evidence from the Euro area

Arachi G., Assisi D., 2020 – International Tax and Public Finance.

Can economic growth be promoted and enhanced by changing the structure of the tax system?

International organizations, such as the OECD and the European Commission, have long argued that taxes can be ranked according to their effects on the economy: from those that are considered most harmful for economic growth, namely taxes on capital and labor, to those that seem to be more neutral, such as taxes on consumption and wealth. In fact, a common suggestion is to shift the tax burden from the former to the latter. In particular, in recent recommendations the European Commission has several times encouraged the Member States, and among them Italy, to rebalance the tax burden through a reduction in labor taxes compensated by an increase in VAT. Indeed, the tax shift from labor taxes to VAT might be considered the channel to stimulate the economic growth through an improvement in domestic firms’ competitiveness. As argued by Keynes in the 1930s, a tax change may in theory mimic the effects of a nominal devaluation.

To understand the mechanism underlying such a shift, known in literature as “fiscal devaluation”, consider a reduction in employers’ social security contributions offset by an increase in VAT. In the short run, with fixed nominal wages, a reduction in employers’ social security contributions would lead to a reduction in labor costs, producing its effects on domestically produced goods, both domestically consumed and exported. An increase in VAT would affect domestically consumed goods, both domestically produced and imported. It would not affect, instead, exports which are zero-rated. Overall, the proposed tax shift would increase the price of imported goods relative to domestically produced goods.

The possibility that the effects of a nominal devaluation can be replicated through a tax shift, is, obviously, particularly attractive for countries in a fixed exchange rates regime, or for those, such as Italy, that have joined a monetary union. However, even if the theory seems convincing, the empirical literature has not yet provided a clear evidence on whether and to what extent a fiscal devaluation can actually improve a country’s terms of trade.

Giampaolo Arachi and Debora Assisi contributes to fill the gap in the literature in a recent paper, Fiscal devaluation and relative prices: evidence from the Euro area published in International Tax and Public Finance: they analyze the effects of a change in social security contributions and VAT for the 11 countries that have joined the European monetary union since 1999.

The analysis shows that when fiscal reforms in euro area countries move in opposite directions, where one country fiscally devalues while its trading partners implement a fiscal revaluation, both the real effective exchange rate and the terms of trade depreciate in the short run, according to the theoretical predictions. On average, however, the effects are rather weak and in some cases the authors can not reject the hypothesis that coefficients are different from zero. The limited impact of the fiscal devaluation is also reflected on quantity adjustment, as the average change in net exports (albeit positive) is not statistically significant. In the long run, the effects vanish both on relative prices and on net exports.

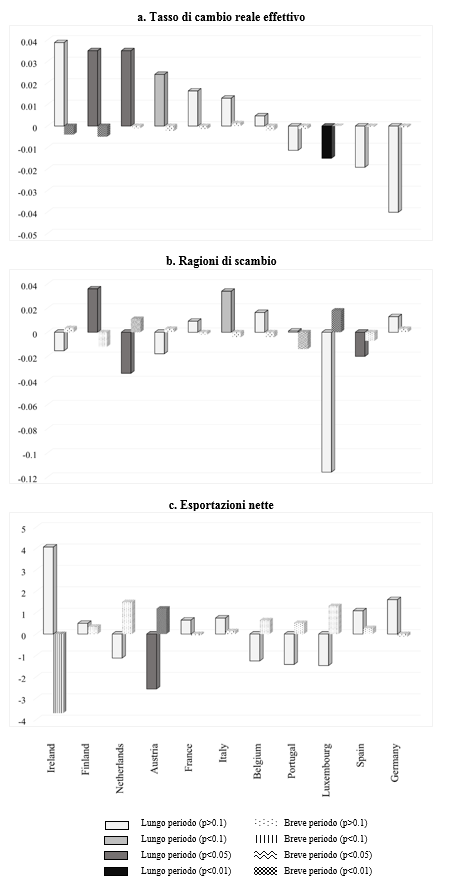

However, the study highlights that the effects are highly heterogeneous across countries. These differences are reported in Figure 1.

Figure 1 Country-specific effects of fiscal devaluation

Unlike the other countries, Italy does not experience a short run depreciation of the real effective exchange rate. A statistically significant short run depreciation is found instead for Finland and Ireland. The results are even more heterogenous for the terms of trade, for which the results do not highlight a clear evidence of a short run depreciation. Finally, as to the impact on net exports, for most of the countries the tax policy leads to a positive effect. One notable exception is Ireland, for which, despite the significant short run real effective exchange rate depreciation, the trade balance deteriorates in the short run. Focusing on the long run effects, these, in general, move in opposite directions of the short run responses, confirming that the impact of a fiscal devaluation, even when corroborating with the theory, tends to mitigate or even reverse over time.

Overall, the analysis shows that theoretical predictions on fiscal devaluation are not strongly confirmed by the data. The effects both on relative prices and on quantities are in fact rather limited. Most importantly, the responses to a fiscal devaluation are highly heterogeneous across countries. This leads to two important economic policy conclusions. First, the effectiveness of a fiscal devaluation has to be assessed on the base of country-specific characteristics. For Italy, for instance, the effects seem to be overall positive with an improvement of net exports in the short run. Second, even when it appears to be efficient, the fiscal devaluation does not seem to give a decisive contribution in restoring international competitiveness.